Digitization Vouchers 2022, now Voucher Connectivity, extended until December 2023, are still active, through an interlude with the European Commission.

This was confirmed in a note published on the official portal of the Ministry of Business and Made in Italy (formerly MISE).

Let’s see what they consist of and, how to apply for them and what other financing is active for SMEs and MPMIs.

Sommario

- 1 Italy lags behind in digital skills

- 2 What digitization vouchers 2023 are aimed at.

- 3 Digitization voucher 2023, how to get bonuses

- 4 How to access

- 5 Other incentives in Agenda 22-23

- 6 Request a consultation with our experts now

- 7 Training 4.0 tax credit

- 8 Fund for industrial and biomedical research and development

- 9 The tax credit for investment in capital goods

- 10 Capital goods – New Sabatini

- 11 News and updates on the New Sabatini

- 12 Why choose Fastbrain

- 13 Contact us for a free consultation

Italy lags behind in digital skills

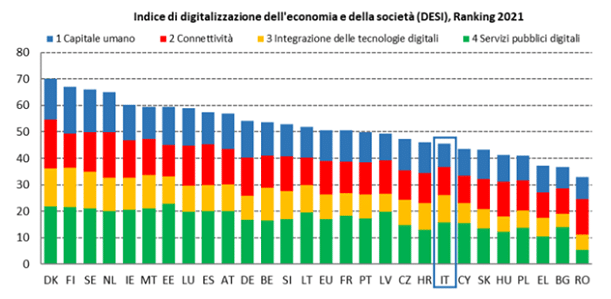

Italy lags behind on the European chessboard in digital skills; in fact, it is third to last (42 percent) compared to the EU average of 56 percent.

In the European Commission Annual Report, Italy ranks 20th out of the 27 EU member states and scores five points below the average: 45.5 versus 50.7.

In pole are Scandinavian countries such as Denmark, Finland, Sweden and the Netherlands (nearly 70 points), while Italy is in last place.

While there is a glimmer for the integration of digital technologies in the company, (69 percent) the use of big data and e-commerce (9 percent) is still weak. Above the European average, cloud service use is also above average (38 percent).

What digitization vouchers 2023 are aimed at.

The NRP makes available about 608,238,104 euros to help small and medium-sized Italian businesses.

The goal is to align with the guidelines of the National Recovery and Resilience Plan, which sees digitization as a key to revitalizing the country’s economy.

A much-needed measure to appear the obvious gap with other European states, identified mainly in the delays concerning human capital (basic and advanced skills, development).

The other measures identified by the DESI (Index of Digitization of Economy and Society), namely connectivity, digital technology integration-degree of digitization in business, e-commerce-digital public services- e-government-are also found to be lagging behind in the EU.

Digitization voucher 2023, how to get bonuses

Specifically, the 2023 digitization voucher is Phase II of the Voucher Plan that the current government recently confirmed.

The first phase was intended for families with ISEE up to twenty thousand euros.

In addition to getting all the documentation you need on the dedicated site, it is important to check the availability of resources on the portal, where the situation regarding available funds is updated daily.

The 2023 digitization voucher is reserved for registered companies residing on the territory of Italy. The subsidy is not provided for a change of service but is valid if you already have a subscription with a telecommunications operator.

It is basically vouchers for the purchase of subscription services for ultra-fast internet (18-24 months) and is designed to support the connectivity demands of micro and small and medium enterprises.

The purpose is also to provide an additional means of improving the speed of business connection and the resulting communication activities.

To whom it is addressed

- Micro, small and medium-sized enterprises;

- IndividualsVAT-registeredindividuals practicing, on their own or in associated form;

- An intellectual profession(Article 2229 of the Civil Code) or one of the unorganized professions(Law No. 4 of January 14, 2013).

The resources, recovered from the 2014-2020 Development and Cohesion Fund, total €589 million with Bonuses from €300 to €2,500 for business connectivity, disbursed as follows:

Digitalization Voucher 2023 – A1

Voucher with connectivity subsidy of 300 euros for an 18-month contract that guarantees the transition to connectivity with maximum download speed within the range 30 Mbit/s – 300 Mbit/s.

Digitalization Voucher 2023 – A2

Voucher with a connectivity contribution of 300 euros for an 18-month contract that guarantees the transition to connectivity with maximum download speed in the range 300 Mbit/s – 1 Gbit/s. For connections offering speeds of 1 Gbit, the voucher may be increased by an additional contribution of up to 500 euros against network connection costs incurred by beneficiaries.

Digitalization Voucher 2023 – B

Voucher with a connectivity contribution of 500 euros for an 18-month contract that guarantees the transition to connectivity with maximum download speed in the range 300 Mbit/s – 1 Gbit/s. For connections offering speeds of 1 Gbit, the voucher may be increased by an additional contribution of up to 500 euros against network connection costs incurred by beneficiaries.

(There is a minimum guaranteed bandwidth threshold of at least 30 Mbit/s for this type of voucher.)

Digitalization Voucher 2023 – C

Voucher with a connectivity contribution of 2,000 euros for a 24-month contract that guarantees the transition to connectivity with a maximum download speed of more than 1 Gbit/s. The voucher may be increased by an additional contribution of up to 500 euros for grid connection costs incurred by beneficiaries.

(There is a minimum guaranteed bandwidth threshold of at least 100 Mbit/s for this type of voucher.)

How to access

A handbook and complete forms are provided for access on the site:

access the formsYou may alternatively contact the following contacts for information:

An operations manual is also made available to facilitate access.

Other incentives in Agenda 22-23

Tax credit for professional chefs

Other incentives prepared and still valid or to be activated include those given to the restaurant industry, such as the tax credit for professional chefs:

This new measure to support cooks is being implemented and applications can be submitted from February 27 to April 3, 2023.

The link to the computer procedure will be made available soon on the dedicated page.

What the facilitation consists of

Through the provision of a tax credit, the measure supports the restaurant industry (restrictive measures taken due to COVID-19 are also considered).

It is granted to the maximum extent of 40 percent of the cost of eligible expenses incurred between January 1, 2021 and December 31, 2022.

The maximum facility that can be granted to each beneficiary cannot, however, exceed the amount of 6 thousand euros.

The credit is issued to individuals who work as professional cooks in hotels and restaurants.

These are the requirements for obtaining the credit:

- Being a resident or established of the state territory;

- To be employed, with a regular employment contract, by hotels and restaurants, or to hold a VAT number for professional chef activities carried out in the same aforementioned establishments, at least as of the date of January 1, 2021, and more specifically:

- To have been employed, by hotels and restaurants, under a regular active employment contract during all or part of the period between January 1, 2021 and December 31, 2022, or

- To have been a VAT number holder, for professional chef activities at hotels and restaurants, during all or part of the period between January 1, 2021 and December 31, 2022;

- Be in the full enjoyment of civil rights.

Eligible expenses include:

- The purchase of high-energy-class machinery intended for the storage, processing, transformation and cooking of food products;

- The purchase of professional catering tools and equipment;

- Participation in professional development courses.

Read the full fact sheet here.

How to access

Applications may be submitted from 12:00 noon on February 27, 2023, until 3:00 p.m. on April 3, 2023, exclusively through the computer procedure accessible at the link soon to be made available on the dedicated page.

Information and clarifications regarding the relevant regulations from applicants can be written to the e- mail address: bonuscuochiprofessionisti@mise.gov.it

Source : https://www.mise.gov.it/it/incentivi

The following initiatives are part of the New Transition 4.0 plan to stimulate investment.

Training 4.0 tax credit

It is a facility in the form of a tax credit that is aimed at financing personnel training expenses.

The aim is to consolidate the digital skills (an Italian gap we discussed in the first part of this article) of employees, in alignment with the technological transformation envisioned by the national Enterprise 4.0 Plan.

The data communication template, to be submitted electronically via PEC to formazione4.0@pec.mise.gov.it, is available here.

How the credit is recognized

- 70% of eligible expenses up to a maximum annual limit of 300 thousand euros for the small businesses, provided that the training activities are provided by the entities identified by the soon-to-be-issued decree of the Minister of Economic Development, and that the results related to the acquisition or consolidation of the aforementioned skills are certified in accordance with the procedures established by the same ministerial decree;

- 50% of eligible expenses up to an annual limit of 250 thousand euros for the medium-sized enterprises, provided that the training activities are provided by the entities identified by the soon-to-be-issued decree of the Minister of Economic Development, and that the results related to the acquisition or consolidation of the aforementioned skills are certified in accordance with the procedures established by the same ministerial decree;

- 30% of eligible expenses for large enterprises up to an annual limit of 250 thousand euros.

Eligible training activities

Training activities should cover: sales and marketing, information technology, production techniques and technology.

Themes of Training 4.0

- Big data and data analytics;

- Cloud and fog computing;

- Cyber security;

- Simulation and cyber-physical systems;

- Rapid prototyping;

- Visualization systems, virtual reality (rv) and augmented reality (ra);

- Advanced and collaborative robotics;

- Human-machine interface;

- Additive manufacturing (or three-dimensional printing);

- Internet of Things and Machines;

- Digital integration of business processes.

To whom it is addressed

All enterprises resident in the territory of the state, including permanent establishments of nonresident entities, regardless of their legal nature, economic sector, size, accounting regime and system of determining income for tax purposes.

How to access

The tax credit must be reported in the tax return for the tax period in which the expenses were incurred and in those for subsequent tax periods until its use ends.

The credit can be used, exclusively by offsetting, starting from the tax period following the one in which the eligible expenses were incurred, by submitting the F24 form through the telematic services made available by the Revenue Agency.

Contact: E-mail: transizione4.0@mise.gov.it

To assess eligibility, see the full fact sheet.

Here all the complete and updated incentives of the National Transition 4.0 Plan.

Fund for industrial and biomedical research and development

The fund aims at industrial reconversion in the biomedical sector through the:

- Production of new drugs and vaccines;

- Diagnostic and medical device products;

- Realization of highly specialized clusters, including the implementation of biomedical and telemedicine sector development programs.

The focus is also on strengthening the national production system of medical equipment and devices as well as’ technologies and services aimed at the prevention of health emergencies.

The decree for the implementation of the fund is being published in the official gazette.

How to access

To gain access, you must request the necessary info here from Division V – Access to Credit and Tax Incentives

To Dr. QUAGLIANA Joseph

America Avenue ,201 – 144 Rome

(+39) 06 5492 7834

E-mail giuseppe.quagliana@mise.gov.it

Pec dgiai.div5@pec.mise.gov.it

Here is the full incentive fact sheet.

The tax credit for investment in capital goods

It consists of incentives for the technological and digital transformation of enterprises.

We discussed it in detail here.

Who to contact

Directorate General for Industrial Policy, Innovation and SMEs.

Division II – Policy for digitization of enterprises and analysis of production sectors.

Ministry of Economic Development

e-mail: transizione4.0@mise.gov.it

Full fact sheet on capital goods tax credit with updates here.

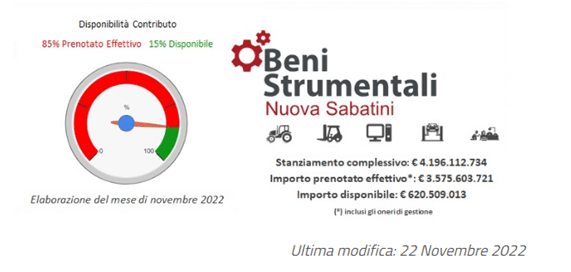

Capital goods – New Sabatini

We discussed this in detail in this article. The New Sabatini offers access to credit for investment in capital goods.

https://www.mise.gov.it/it/incentivi/agevolazioni-per-gli-investimenti-delle-pmi-in-beni-strumentali-nuova-sabatini

What it consists of

- The Capital Goods measure (“New Sabatini”) is the facility made available by the Ministry of Business and Made in Italy with the aim of facilitating companies’ access to credit and increasing the competitiveness of the country’s production system

- The facility supports investments to purchase or acquire on lease machinery, equipment, plant, capital goods for productive use and hardware, as well as software and digital technologies.

Eligible for the facility are micro, small and medium-sized enterprises (MSMEs) duly incorporated and registered in the Register of Enterprises or the Register of Fishing Enterprises

News and updates on the New Sabatini

In addition to the 2023 digitization vouchers, other new features announced by the facility are two new lines of intervention:

- New Sabatini Green (environmentally sustainable projects);

- New Sabatini South (Companies located in the South).

As of January 1, 2023, the SME, upon completion of the investment and upon payment of the balance of the invested assets, must fill out, in digital format and exclusively through the procedure available on the platform (https://benistrumentali.dgiai.gov.it/Imprese), special application for disbursement of the grant (Form RU) and sends it to the Ministry, together with the additional required documentation.

The procedures for applying for the grant are described in the section Capital goods (“New Sabatini”) – Grant disbursement.

Submission of applications:

https://www.mise.gov.it/index.php/it/incentivi/beni-strumentali-nuova-sabatini-presentazione-domande

Renew your SME's technologies now and make it competitive againWhy choose Fastbrain

Fastbrain Engineering S.r.l. Certified Partner of leading technology players, including Brother, Lenovo, Synology, offers customized purchasing solutions tailored to the needs of professionals. It offers, in addition, pre- and post-sales support, including operational rental.

We are a central player in ICT wholesale distribution and one of the leading players throughout the country in the IT and technology product distribution market. A key feature and competitive advantage is the selection of top brands and leading products in the most popular product categories.

Info:

info@fastbrain.it

| Tel 011.0376.054